A voter recently asked me the following on Facebook: “So how would you make up the revenue short fall; this is a perennial problem in a small state like New Hampshire. It’s either super high property taxes, or high taxes on prepared food rooms and meals, what do you propose?”

Here’s my response:

“High taxes are the result of high spending, so I’d start there.

NH has about a $13B biennial budget, iirc, and I’m sure there’s all kinds of fat in there–maybe it’s time for an audit, plus some flow charts showing us what each department gets and how the money is spent, down to the salaries, pensions, and other liabilities (funded and unfunded). Also, when you allow markets to operate freely, prices go down (unlike when you get the government involved, where they only know one direction, and that’s UP, UP, UP! <–easy to spend other people’s money!).

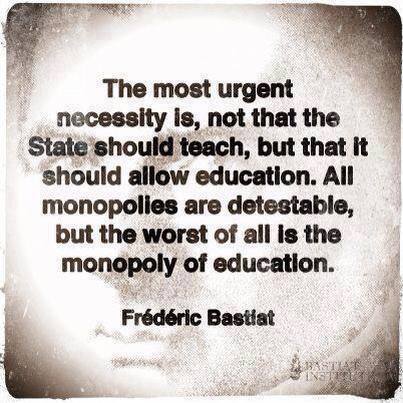

We are also not getting our monies worth in the current education system, where enrollment and results are going down precipitously as costs go up, so that needs an overhaul too. Of course, when Democrats refuse allocated funds like the $46M that was supposed to go to PUBLIC charter schools, it’s easy to see where to place some of the blame.

So what do I propose? Embracing the NH Advantage in its truest sense, allowing our friends and neighbors to run their businesses as unfettered as possible, fixing the schools by introducing more parental choices which will drive down costs while improving actual educational outcomes (doesn’t seem unreasonable that for approx. $16K per child, the kid should be able TO READ), reducing business taxes, and auditing and possibly eliminating unnecessary programs.

Nothing is written in stone, of course, and should allowing more freedom not work, we can always tweak things, but here’s one thing I 100% know, more and more government involvement in our lives leads to worse and worse outcomes! I want us to #LiveFreeAndThrive. That starts with “Live free”!”